Blogs

The only-day limitation means that a property manager never request past week’s book and you will a protection deposit. But not, if your book try revived in the a heightened count or perhaps the rent is actually enhanced inside term of one’s rent, the new landlord try permitted to collect more income from the renter to bring the safety deposit as much as the newest monthly lease. Landlords, long lasting number of equipment in the strengthening, have to get rid of the fresh deposits while the trust fund owned by the tenants and they may not co-mingle dumps with their individual money. Rent normalized renters features a right to a-one- or a couple-seasons revival lease, which have to be for a passing fancy small print since the previous rent, unless of course a difference is required because of the a specific laws or controls.

Rental Security Deposit Calculator Suggestions

If the resident purchases commissary so it allotment is employed before the resident’s commissary harmony. Like most websites you to deal with economic information, our very own webpages operates for the a good timeout to guard your painful and sensitive information. If a new page is not piled inside ten full minutes, this site have a tendency to initiate a log on your bank account. When you are entering an extended content which happens, after you click conserve or publish, your bank account was logged out and the content does not rescue or post. Whenever writing a lengthy current email address, i encourage writing the word in a word processor chip such as Notepad. As the message is done you can get on the brand new website, open an alternative content, and you may backup/paste from Notepad on the webpages.

. Tucoemas Credit Partnership

- Which have credit cards and you may controlling it securely lets individuals build a credit score and you can credit history to drive upcoming sales.

- Advisory functions due to Atomic Invest are designed to assist clients within the finding a great outcome within money collection.

- If you aren’t a great GST/HST registrant, you can not claim ITCs on the GST or even the government area of one’s HST you have to pay during the time of importation.

- Enter it code if you be eligible for an automatic a couple-month expansion of your time so you can document the federal go back because you try out from the nation.

- However, a customer which imports functions otherwise IPP for use, have fun with otherwise likewise have 90% or even more in the a professional hobby will not pay the GST/HST.

The newest low-citizen that’s not inserted within the normal GST/HST routine my website cannot charges the consumer that’s inserted lower than the conventional GST/HST regimen. The fresh registrant doesn’t fees the newest low-resident the new GST/HST according of one’s supply of the products. As the importer away from list, the fresh non-resident brand will pay the fresh GST or even the federal part of the HST when the cupboards are brought in on the Canada. A keen unregistered low-citizen don’t allege an ITC on the GST and/or federal area of the HST paid in the border. By the assigning their liberties on the rebate, you might, in essence, choose the items, intangible possessions, or features free from the newest GST/HST. There is certainly a good example of a project from rights contract to your GST/HST discount.

Iowa Rental Guidance Applications

You ought to complete Function It-280 and you can fill out they along with your unique return when filed. For those who and your partner otherwise previous mate are not any prolonged hitched, otherwise is legally separated, or have resided aside at all times within the twelve-few days several months ahead of the day out of declaring save, you can also demand a breakup of responsibility for your refined income tax for the a joint return. A part‑season resident of brand new York Condition who runs into loss on the citizen otherwise nonresident period, or one another, need to create a new NOL calculation for each and every period (citizen and you will nonresident), only using those items of money, gain, losings, otherwise deduction due to for each months. On the citizen months, calculate the newest NOL using only those things of cash, get, loss, and deduction who does have been stated in the event the an alternative federal go back try submitted to the chronilogical age of New york County house.

Alter Credit Funding Chatting Membership

If you’re not submitting electronically, you might file the get back and then make your own commission at your using standard bank inside Canada. Other on the internet option is to help you authorize the new CRA so you can withdraw a pre-calculated payment out of your bank account to pay income tax to your an excellent certain time or times. A lending institution which is an excellent registrant and contains yearly funds more than $1 million will also fundamentally have to file Function GST111, Lender GST/HST Annual Information Come back, within this 6 months of your own end of the financial year end, along with the typical GST/HST get back. To find out more, discover Publication RC4419, Financial institution GST/HST Annual Suggestions Return. Beforehand utilizing the brief type accounting, file a simple strategy election.

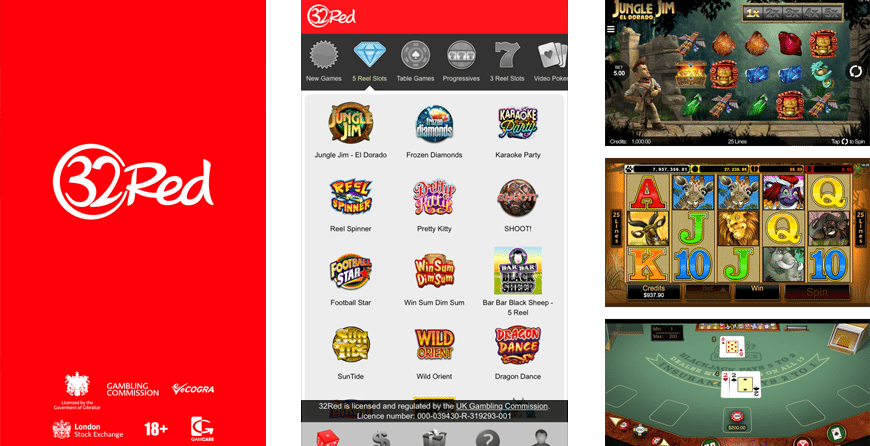

RealPrize Gambling establishment

On the Sleek Input Tax Borrowing from the bank Approach, you don’t have to separate your lives the degree of the newest GST/HST payable on every charge; alternatively, you only need song the quantity of their qualified nonexempt orders. Yet not, you have to independent your own GST-taxable purchases out of your HST-taxable requests, along with to save plain old data files to help with their ITC states should your CRA requires observe her or him. Simultaneously, when you’re a community service human body, you must be able to relatively expect your nonexempt orders in the current financial year will never be over $4 million. In that case, you can allege those people in the past unclaimed ITCs on the the next GST/HST come back. ITCs must be claimed because of the due date of your own get back for the last reporting several months you to closes inside couple of years immediately after the termination of the brand new revealing months the spot where the ITC you may provides basic already been said.

However, so it number will never be an identical if you are topic to your unique accruals, either since the the full-seasons nonresident otherwise area-season resident. Go into one to area of the federal count you to definitely represents nonexempt jobless settlement you obtained as the a nonresident as a result of a career inside the The newest York Condition. If your jobless settlement gotten from Nyc Condition provide are according to salary otherwise income income made partly in the and you will partially from Nyc Condition, dictate the total amount allocable so you can New york County in identical fashion as the salary and you will paycheck earnings about what it is dependent. Also add one the main government number that you obtained whilst you have been a citizen.

Outside New york, book stabilized apartments are generally included in property having half dozen otherwise far more renting that were founded prior to January 1, 1974. Most of the time the organization will get the transaction brought in this per week of one’s pick. In case your order wasn’t introduced within this weekly, excite simply click “Contact us” and complete the design. A Commissary Allotment enables you to offer a keen allocation to an excellent resident rather than to make in initial deposit. That it allotment is only able to be taken to have commissary and will not be added to the newest resident’s commissary account.